Revised rules require fresh advice but clients often blame their tax professional, says Tim Munro.

Changes to working from home deduction – started 1 Jul 2022

Check your eligibility to calculate your working from home expenses using the fixed rate method – 67 cents per hour.

Later retirement takes oldies back to living in ’70s

The labour shortage and increased workplace flexibility has seen potential retirees remain in the workforce for longer, says KPMG.

Sharing economy reporting regime commences soon

Details of tax calculation for $3m threshold a ‘mixed blessing

The proposed tax on earnings calculation for balances exceeding $3 million will see some members paying tax on unrealised earnings, says the SMSF Association.

Comparison: How Long It Takes To Decompose?

Check out how long everyday items take to decompose.

Using your business money and assets for private purposes

You may need to report money and assets taken from your company or trust as income in your tax return.

Capital gains tax

How to calculate capital gains tax (CGT) on your assets, assets that are affected, and the CGT discount.

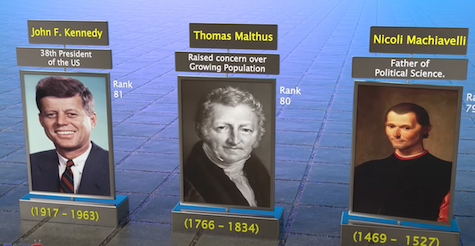

100 Most Influential people in the world.

Check out the people that changed the world

Changes to Australian Business Number (ABN) registration compliance

As part of the government’s intention to “strengthen” the ABN system, Treasury has released

draft legislation to imposing new compliance obligations for ABN holders to retain their

ABN.